|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Analysts Have High Hopes for Nvidia Ahead of August 27. Should You Buy NVDA Stock Here?/NVIDIA%20Corp%20video%20chip-by%20Antonio%20Bordunovi%20via%20iStock.jpg)

Multiple investment firms boosted Nvidia (NVDA) stock price targets ahead of its Aug. 27 earnings report, with analyst expectations showing strong momentum. According to a report from Seeking Alpha, KeyBanc raised its NVDA stock price target to $215 from $190, Susquehanna increased it to $210 from $180, and HSBC hiked it to $200 from $125. For fiscal 2026 (ending in January), analysts forecast revenue of $202.44 billion, while the top-line for 2027 is projected at $259.36 billion, up from $130.5 billion in fiscal 2025. Current quarter expectations call for $45.97 billion in revenue, representing 53% year-over-year growth. Earnings per share are expected to increase to $1.01 per share in fiscal Q2 of 2026, up from $0.68 per share last year. However, China uncertainties loom large. KeyBanc expects guidance excluding direct China revenue due to pending license approvals, though inclusion could add $2-3 billion. HSBC notes the artificial intelligence (AI) GPU market exceeded expectations but warns of China-related risks, including lower pricing and potential pushback from Chinese authorities.

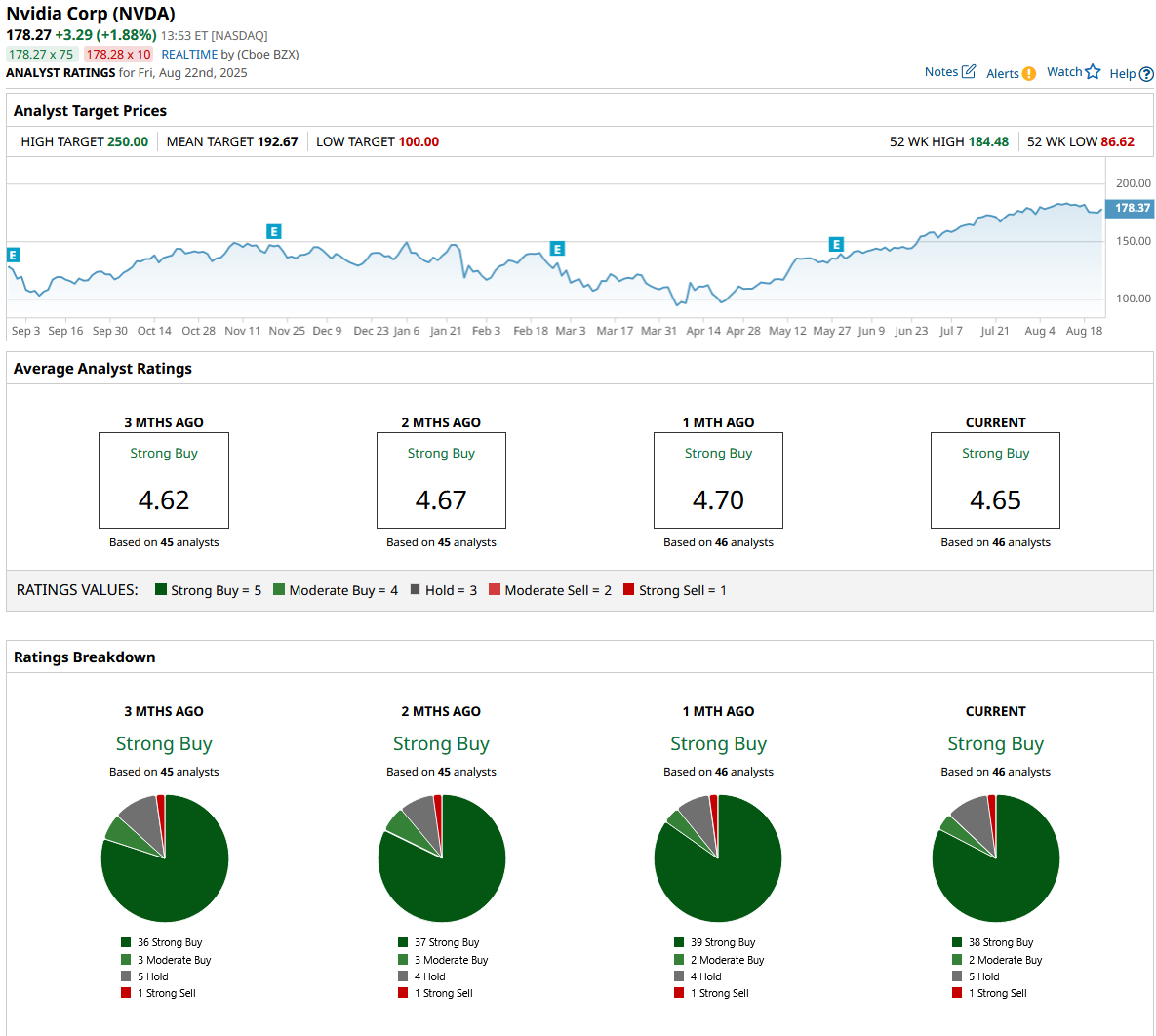

Is Nvidia Still a Good Stock to Buy?In fiscal Q1, Nvidia reported revenue of $44 billion, an increase of 69% year-over-year (YoY), showcasing the company's commanding position in the AI revolution that's reshaping global computing infrastructure. Nvidia’s multi-platform strategy positions it perfectly for sustained long-term growth across several expanding markets. The transition to NVIDIA's Blackwell architecture has been remarkable, contributing nearly 70% of Data Center compute revenue with the fastest product ramp in company history. Major hyperscalers are deploying almost 1,000 NVL72 racks weekly, equivalent to 72,000 Blackwell GPUs per week. This massive scale demonstrates both customer confidence and NVIDIA's manufacturing excellence. Microsoft (MSFT) alone has deployed tens of thousands of Blackwell GPUs and plans to scale to hundreds of thousands of GB200s. The emergence of reasoning AI models has fundamentally changed the compute landscape. Microsoft processed over 100 trillion tokens in Q1, a fivefold YoY increase. DeepSeek and similar reasoning models generate 13 times more tokens than traditional AI models, creating exponential inference demand. NVIDIA's GB200 NVL72 delivers 30 times higher inference throughput, making it the ideal platform for this compute-intensive workload. Multiple Emerging Growth Vectors for NVDA StockNvidia's business extends far beyond data center GPUs. Gaming revenue hit record levels at $3.8 billion in Q1, growing 48% sequentially. The recently released Nintendo Switch 2 leverages Nvidia's custom RTX technology, tapping into its predecessor's 150-million-console installed base. Networking revenue surged 64% quarter-over-quarter (QoQ) to $5 billion, with Spectrum-X annualizing over $8 billion as major cloud providers adopt NVIDIA's enhanced Ethernet solutions. Sovereign AI represents a massive new opportunity as nations recognize AI as essential infrastructure. Nearly 100 AI factories are currently under construction globally, with projects requiring tens of gigawatts of Nvidia infrastructure on the horizon. Enterprise AI is accelerating with new RTX Pro systems enabling on-premises deployment, addressing the $500 billion IT infrastructure market. Moreover, Nvidia returned a record $14.3 billion to shareholders through buybacks and dividends, demonstrating management's confidence in future cash generation. What Is the Target Price for NVDA Stock?Analysts tracking NVDA stock forecast revenue to rise from $130.5 billion in fiscal 2025 to $362.5 billion in 2030. In this period, adjusted earnings are forecast to expand from $2.99 per share to $8.67 per share. Today, NVDA stock trades at a forward price to earnings multiple of 35x, which is higher than its 10-year average of 32x. As growth normalizes, NVDA stock could revert to an earnings multiple of 25x, which suggests it will trade around $217 in early 2029, indicating an upside potential of 24% from current levels. Out of the 46 analysts covering NVDA stock, 38 recommend “Strong Buy,” two recommend “Moderate Buy,” five recommend “Hold,” and one recommends “Strong Sell.” The average NVDA stock price target is $192, above the current price of $178.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|